I often meet young couples these days who are in a slight panic about the need to buy a house before prices start to rise again. With demand low and supply high, I don’t see prices climbing significantly upwards over the next year or two.

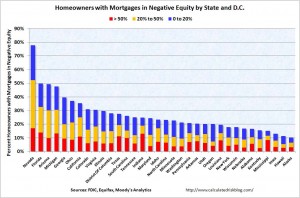

Here is a quick breakdown of the number of homes that are underwater on their mortgages. Many homes that are more than 20% underwater will likely default at some point (these numbers are from 2010Q1).

In 2000, no state had more than 2% of mortgages underwater.

Home Negative Equity by State

I often meet young couples these days who are in a slight panic about the need to buy a house before prices start to rise again. With demand low and supply high, I don’t see prices climbing significantly upwards over the next year or two.

Here is a quick breakdown of the number of homes that are underwater on their mortgages. Many homes that are more than 20% underwater will likely default at some point (these numbers are from 2010Q1).

In 2000, no state had more than 2% of mortgages underwater.

This entry was posted by David on November 2, 2010 at 12:59 pm, and is filed under Commentary. Follow any responses to this post through RSS 2.0.You can leave a response or trackback from your own site.