What’s a Pension Worth

Defined benefit pensions are a dying breed. While they are still common in federal and state government jobs, they are quickly disappearing in commercial companies. So if a person wanted to create their own pension how much would that cost?

Let’s take a quick look at the Federal Employees Retirement System (FERS).

With 20 years of service the full retirement age is 60. The pension amount is %1/year of service X high 3 average pay. So 20 years of service results in a pension worth 20% of the person’s high 3 salary. This pension then increases with inflation (with 1% lag when inflation is over 3%).

So to duplicate this deal, how much would you need to save?

Assumptions:

- Salary increases 1% faster than inflation

- Bonds average 2% real return

- Equities average 7% real return (historical, the projected rate is closer to 5% real return)

- An inflation adjusted annuity at age 60 costs $20 for each $1 of income desired (source: AIG).

So in 20 years a $50K salary would grow to around $61K (in today’s dollars). 20% of that is $12,200. We would need $244K in savings (in today’s dollars) to purchase an inflation ajusted annuity that pays $12,200/year.

If we only invest in bonds (to achieve the same level of confidence as a government pension) we would need to save a little over 18% of salary for 20 years. If we assume a risker investment stance (e.g., 50% equities/ 50% bonds), the savings requirement drops to 14.5%.

If you run these kinds of calculations on state and corporate pensions you discover that most state pensions fall in the 15% to 20% equivalent savings while corporate pensions tend to fall into the 10% to 15% equivalent savings. If you factor in lower equity premiums or lower risk (i.e,. few equities), the percentages go even higher.

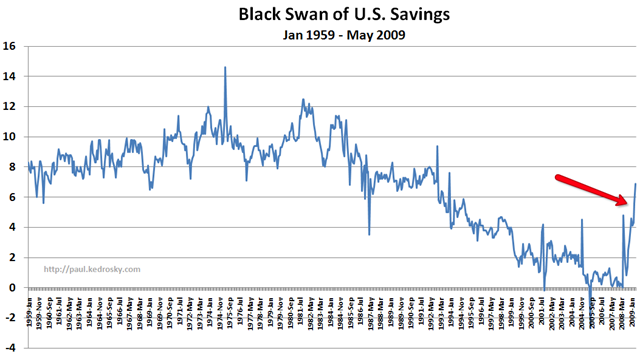

With the national savings rate only recently recovering from 0% to almost 7%, it is clear that most Americans have not been savings anywhere near these rates.