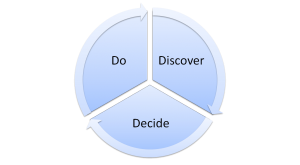

Discover/Decide/Do

Life rarely moves in straight lines. Our goals, circumstances and priorities are always shifting. This requires thinking far beyond risk analysis, model portfolios and financial planning strategies. It requires creativity, expertise and discipline matched with deep personal relationships centered on a singular priority: helping you harness your resources to live your most rewarding life.

Discover

- Discover your hopes and expectations for the future

- Explore your personal, family and community values

- Identify life transitions that you are and expect to be experiencing

- Gather and organize your data and documents

Decide

- Triage your short and long-term goals and aspirations to address your most critical needs first

- Illuminate the potential tradeoffs of financial decisions and how they relate to your goals

- Explain the concepts you need to make informed decisions

- Develop an investment policy that attempts to balance your goals, risk capacity, risk tolerance and market stance

Do

- Strategize and coordinate with your other advisors (e.g., attorneys, accountants, insurance agents, etc.)

- Help implement financial decisions and navigate life transitions

- Effect the investment policy

- Investment selection and trade execution on a nondiscretionary basis

- Re-balance the portfolio when appropriate

- Re-allocate the portfolio due to changes in market valuations or your goals

- Provide performance reports upon request

Fee

$1,500/quarter ($6,000/year) plus

| NET WORTH* | QUARTERLY | ANNUAL |

|---|---|---|

| First $10,000,000 | $250/$250,000 net worth* | $1,000/$250,000 net worth* |

| Over $10,000,000 | $250/$500,000 net worth* | $1,000/$500,000 net worth* |

Fee is based on your net worth* at the time of the engagement and will be adjusted at the end of three years and every three years thereafter based on the advisor’s formula at those times. This quarterly retainer is cancelable anytime without restriction. Fees are payable in arrears on a quarterly basis. For any calendar quarter in which services are provided for less than the full quarter, fees will be prorated based on the percentage of the quarter services were provided. All fees shall be deducted directly from supervised accounts or payable within twenty-one days of invoice receipt.

*Net Worth includes investment assets over which you have control, such as investment accounts, 401(k)s, 403(b)s, vested stock options, etc. Additional fees may be charged for business or real estate analysis.

All fees will have Hawaii’s 4.712% general excise tax added and are negotiable.