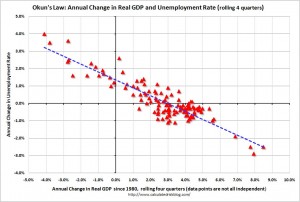

The following graph shows the historical relation between unemployment changes and GDP growth. Real (i.e., before inflation) GDP growth of at least 2% is needed just to stay even. And even high growth doesn’t tend to reduce unemployment by more than 1% a year. With housing and deleveraging continuing, real GDP growth is unlikely to be very high.

With unemployment at 9.8%, a 1% per year decline in unemployment means 4 years before unemployment drops below 6%. And that assumes no recession hits during those 4 years.

GDP Growth Needed to Reduce Unemployment

The following graph shows the historical relation between unemployment changes and GDP growth. Real (i.e., before inflation) GDP growth of at least 2% is needed just to stay even. And even high growth doesn’t tend to reduce unemployment by more than 1% a year. With housing and deleveraging continuing, real GDP growth is unlikely to be very high.

With unemployment at 9.8%, a 1% per year decline in unemployment means 4 years before unemployment drops below 6%. And that assumes no recession hits during those 4 years.

This entry was posted by David on November 9, 2010 at 4:46 pm, and is filed under Commentary. Follow any responses to this post through RSS 2.0.You can leave a response or trackback from your own site.