The combination of record low mortgage rates and housing prices that have fallen significantly over the last two years means many people are asking themselves if now is the right time to buy. This is an attempt to provide some perspective on that questions.

1. Mortgage Rates

Mortgage rates are now the lowest they have been since the late 50’s. While this certainly makes homes more affordable, it also greatly increases the risk of home ownership. This is because rising interest rates put downward pressure on home prices. For example if mortgage rates rise from 4.5% to 6%, that increases the monthly payment by 1/3. If incomes haven’t gone up significantly, then fewer people will be able to afford the payment and the house will likely have to sell for less and it will certainly put a damper on appreciation. It would require a 25% price drop to equalize the payment from the interest rate rise.

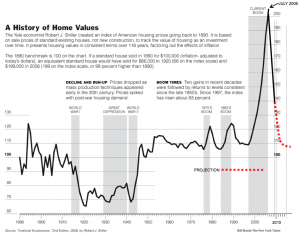

Look at the following Case Shiller graph and you can see there was almost no home appreciation for twenty years as interest rates slowly climbed upwards. from the late 50’s. The graph only goes to the end of 2009. The first quarter of 2010, the index has come in at 129, which would argue that the bottom is still 10% to 20% lower than where we are now. Although this could be achieved by inflation instead of falling prices.

2. Supply and Demand

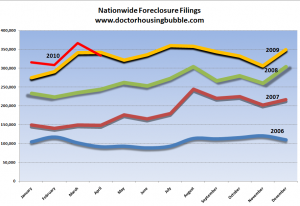

Foreclosure’s are still occurring at a very high rate. Until unemployment improves, this is unlikely to fall anytime soon. And with delinquency to foreclosure taking over a year to process, even when employment starts to pick up, there will be a delay before the housing inventory clears out of the system.

Demand is also still way down as can be seen in the graph to the right. Although it does show how the tax credit pulled demand into April (which will probably mean this summer’s sales will be slower than usual.

3. Homeowner Equity

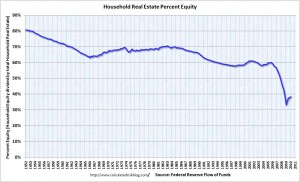

Around a third of homeowners own their homes outright. This means that the remaining 2/3rds have almost no equity in total (obviously there is a spread of those who have equity and those who have negative equity). This will also keep demand depressed because it is hard to trade up if you don’t have enough equity for a down payment on your next house.

Summary

While buying a house now, is certainly lower risk than it has been for most of the past decade, it is not a slam dunk proposition. People need to go back to thinking about their home more as something they consume rather than as an investment. While they may get some good appreciation, it will be a matter of luck not inevitability.

If someone requires geographic mobility for their job (e.g., military) and the job does not insulate them from real estate prices changes, home ownership may not be the right choice right now.

Real Estate – Partly Cloudy with a chance of further decline

The combination of record low mortgage rates and housing prices that have fallen significantly over the last two years means many people are asking themselves if now is the right time to buy. This is an attempt to provide some perspective on that questions.

1. Mortgage Rates

Mortgage rates are now the lowest they have been since the late 50’s. While this certainly makes homes more affordable, it also greatly increases the risk of home ownership. This is because rising interest rates put downward pressure on home prices. For example if mortgage rates rise from 4.5% to 6%, that increases the monthly payment by 1/3. If incomes haven’t gone up significantly, then fewer people will be able to afford the payment and the house will likely have to sell for less and it will certainly put a damper on appreciation. It would require a 25% price drop to equalize the payment from the interest rate rise.

Look at the following Case Shiller graph and you can see there was almost no home appreciation for twenty years as interest rates slowly climbed upwards. from the late 50’s. The graph only goes to the end of 2009. The first quarter of 2010, the index has come in at 129, which would argue that the bottom is still 10% to 20% lower than where we are now. Although this could be achieved by inflation instead of falling prices.

2. Supply and Demand

Foreclosure’s are still occurring at a very high rate. Until unemployment improves, this is unlikely to fall anytime soon. And with delinquency to foreclosure taking over a year to process, even when employment starts to pick up, there will be a delay before the housing inventory clears out of the system.

Demand is also still way down as can be seen in the graph to the right. Although it does show how the tax credit pulled demand into April (which will probably mean this summer’s sales will be slower than usual.

3. Homeowner Equity

Around a third of homeowners own their homes outright. This means that the remaining 2/3rds have almost no equity in total (obviously there is a spread of those who have equity and those who have negative equity). This will also keep demand depressed because it is hard to trade up if you don’t have enough equity for a down payment on your next house.

Summary

While buying a house now, is certainly lower risk than it has been for most of the past decade, it is not a slam dunk proposition. People need to go back to thinking about their home more as something they consume rather than as an investment. While they may get some good appreciation, it will be a matter of luck not inevitability.

If someone requires geographic mobility for their job (e.g., military) and the job does not insulate them from real estate prices changes, home ownership may not be the right choice right now.

This entry was posted by David on June 11, 2010 at 8:55 am, and is filed under Commentary. Follow any responses to this post through RSS 2.0.You can leave a response or trackback from your own site.