Problem Moves to Prime Mortgages

Problem Moves to Prime Mortgages

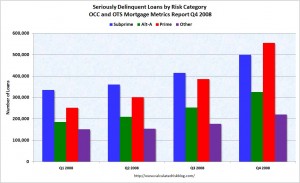

To date foreclosures have been concentraded on the lower end of the housing market. And the lower end could reach a price bottom by next year. The upper end however is only just now starting to work through its problems.

In the chart on the right you can see that prime loan delinquencies are now becoming the dominant problem. And this trend has grown in the first quarter.

Beware of watching the median house price index. As prices start to drop on the high end and more sales start to happen there, this will cause the median price to rise (due to the change in mix of houses sold rather than rising prices). So keep your eye on the Case Schiller Index rather than median prices to know where the market is going.

Months of Supply

Months of Supply

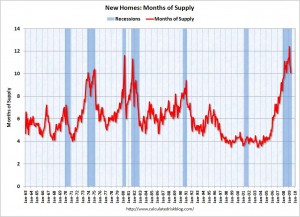

With months of supply over 10 and all the new homes that will still be coming into the market from foreclosures over the next year, there will still be intense pressure pushing prices down further.

Once this goes below 8 months (and more likely 6), that will signal that home prices have stabalized. It will still be a very long time before prices go back up to their previous highs.

Recasting of Option ARMs

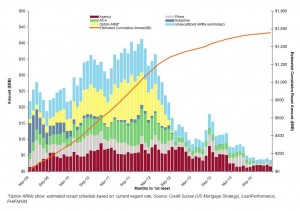

On this graph pay attention to the yellow Option ARMs and see how many of those mortgages will recast in late 2010 and 2011. Option ARMs are typically negative amortizing loans (i.e., person is paying less than the interest being incurred) or interest only and when the loan gets recast it turns into a normal amortizing loan with the required much higher payment. These are problematic because the payment goes up even if interest rates stay low. And with prices down it is unlikely these owners will be able to refinance into another option ARM.

Sources:

Housing Recovery Not Near

To date foreclosures have been concentraded on the lower end of the housing market. And the lower end could reach a price bottom by next year. The upper end however is only just now starting to work through its problems.

In the chart on the right you can see that prime loan delinquencies are now becoming the dominant problem. And this trend has grown in the first quarter.

Beware of watching the median house price index. As prices start to drop on the high end and more sales start to happen there, this will cause the median price to rise (due to the change in mix of houses sold rather than rising prices). So keep your eye on the Case Schiller Index rather than median prices to know where the market is going.

With months of supply over 10 and all the new homes that will still be coming into the market from foreclosures over the next year, there will still be intense pressure pushing prices down further.

Once this goes below 8 months (and more likely 6), that will signal that home prices have stabalized. It will still be a very long time before prices go back up to their previous highs.

Recasting of Option ARMs

On this graph pay attention to the yellow Option ARMs and see how many of those mortgages will recast in late 2010 and 2011. Option ARMs are typically negative amortizing loans (i.e., person is paying less than the interest being incurred) or interest only and when the loan gets recast it turns into a normal amortizing loan with the required much higher payment. These are problematic because the payment goes up even if interest rates stay low. And with prices down it is unlikely these owners will be able to refinance into another option ARM.

Sources:

This entry was posted by David on June 4, 2009 at 10:42 am, and is filed under Commentary. Follow any responses to this post through RSS 2.0.You can leave a response or trackback from your own site.