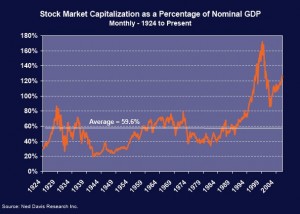

Produced by Ned David Research this graph shows the ratio of stock market capitalization to Nominal GDP in the U.S. from 1924 to 2007.

Unfortunately, I’m not positive if this was constructed using total market capitalization or just the free float, but since the series goes back to 1924 and using free float is a more recent concept, I’m assuming these are total market capitalization numbers.

Today, the US GDP is around $14.4 trillion and the US total market capitalization is around $10.3 trillion. Which gives us a ratio of 71.6%, which is above the long term historical average.

I like this valuation method because it overcomes problems with earnings manipulation, determining the effect of companies retaining earnings and calculating replacement value for companies with lots of intellectual property.

So now we have gone through a number of different valuation techniques and they all point to the fact that we are near or slightly above historically average valuations. The next step will be to examine what long term returns might be expected in this environment.

Sources

Market Cap vs. GDP

Produced by Ned David Research this graph shows the ratio of stock market capitalization to Nominal GDP in the U.S. from 1924 to 2007.

Unfortunately, I’m not positive if this was constructed using total market capitalization or just the free float, but since the series goes back to 1924 and using free float is a more recent concept, I’m assuming these are total market capitalization numbers.

Today, the US GDP is around $14.4 trillion and the US total market capitalization is around $10.3 trillion. Which gives us a ratio of 71.6%, which is above the long term historical average.

I like this valuation method because it overcomes problems with earnings manipulation, determining the effect of companies retaining earnings and calculating replacement value for companies with lots of intellectual property.

So now we have gone through a number of different valuation techniques and they all point to the fact that we are near or slightly above historically average valuations. The next step will be to examine what long term returns might be expected in this environment.

Sources

This entry was posted by David on January 8, 2009 at 8:24 am, and is filed under Commentary. Follow any responses to this post through RSS 2.0.You can leave a response or trackback from your own site.