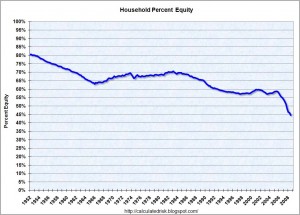

From Calculated Risk we get a graph showing homeowner percent equity since 1952

Approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less equity than 44.7%. Also, when prices were increasing dramatically in recent years, the percent homeowner equity was declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity is dropping dramatically.

If it becomes socially acceptable to walk away from a mortgage, this will be a structural change and will cause a major change to the mortgage landscape and additional pain during the transition.

Vanishing Home Equity

From Calculated Risk we get a graph showing homeowner percent equity since 1952

Approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less equity than 44.7%. Also, when prices were increasing dramatically in recent years, the percent homeowner equity was declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity is dropping dramatically.

If it becomes socially acceptable to walk away from a mortgage, this will be a structural change and will cause a major change to the mortgage landscape and additional pain during the transition.

This entry was posted by David on December 29, 2008 at 7:15 am, and is filed under Commentary. Follow any responses to this post through RSS 2.0.You can leave a response or trackback from your own site.